Explain Any Possible Differences Between Accounting for an Account Receivable

In accounting confusion sometimes arises when working between accounts payable vs accounts receivable. Explain any possible differences between accounting Question.

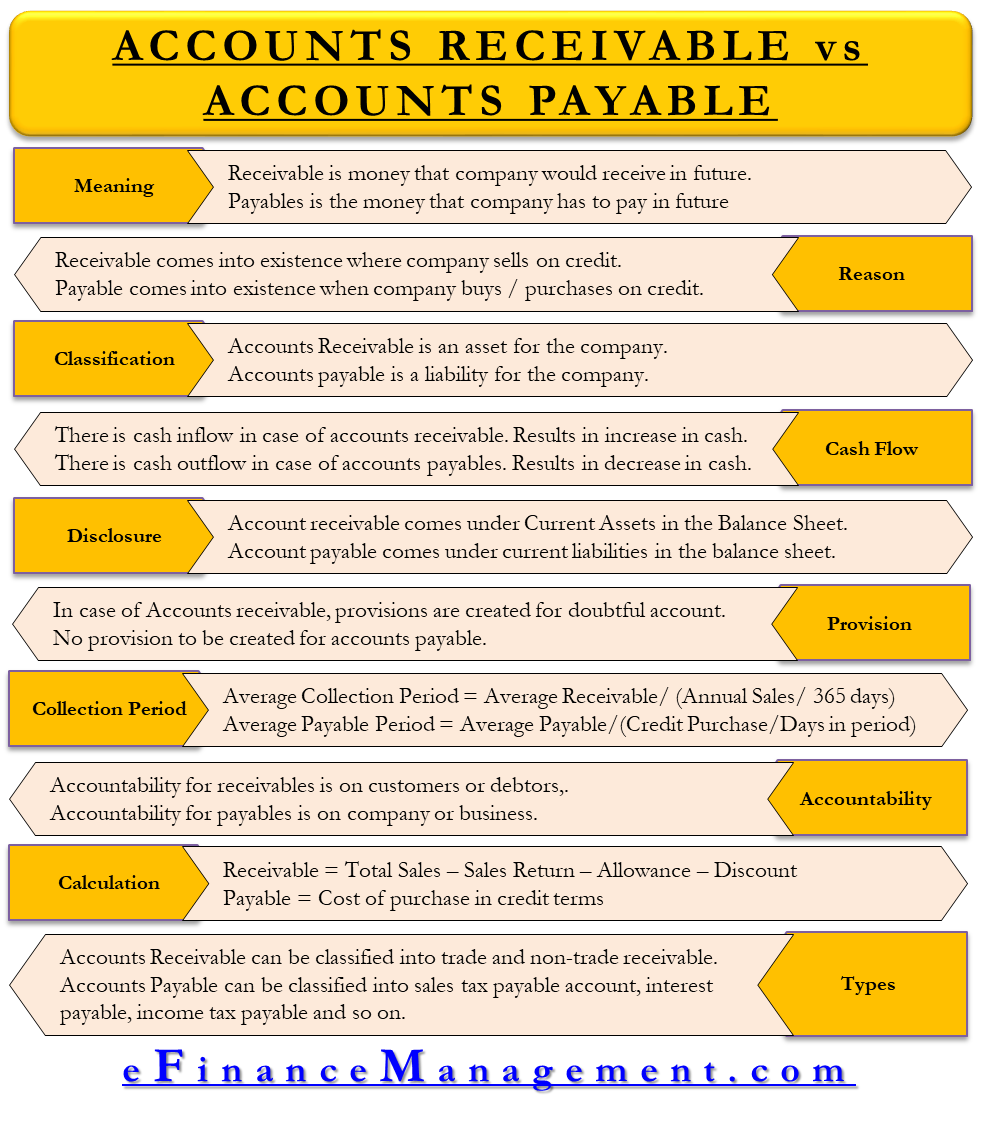

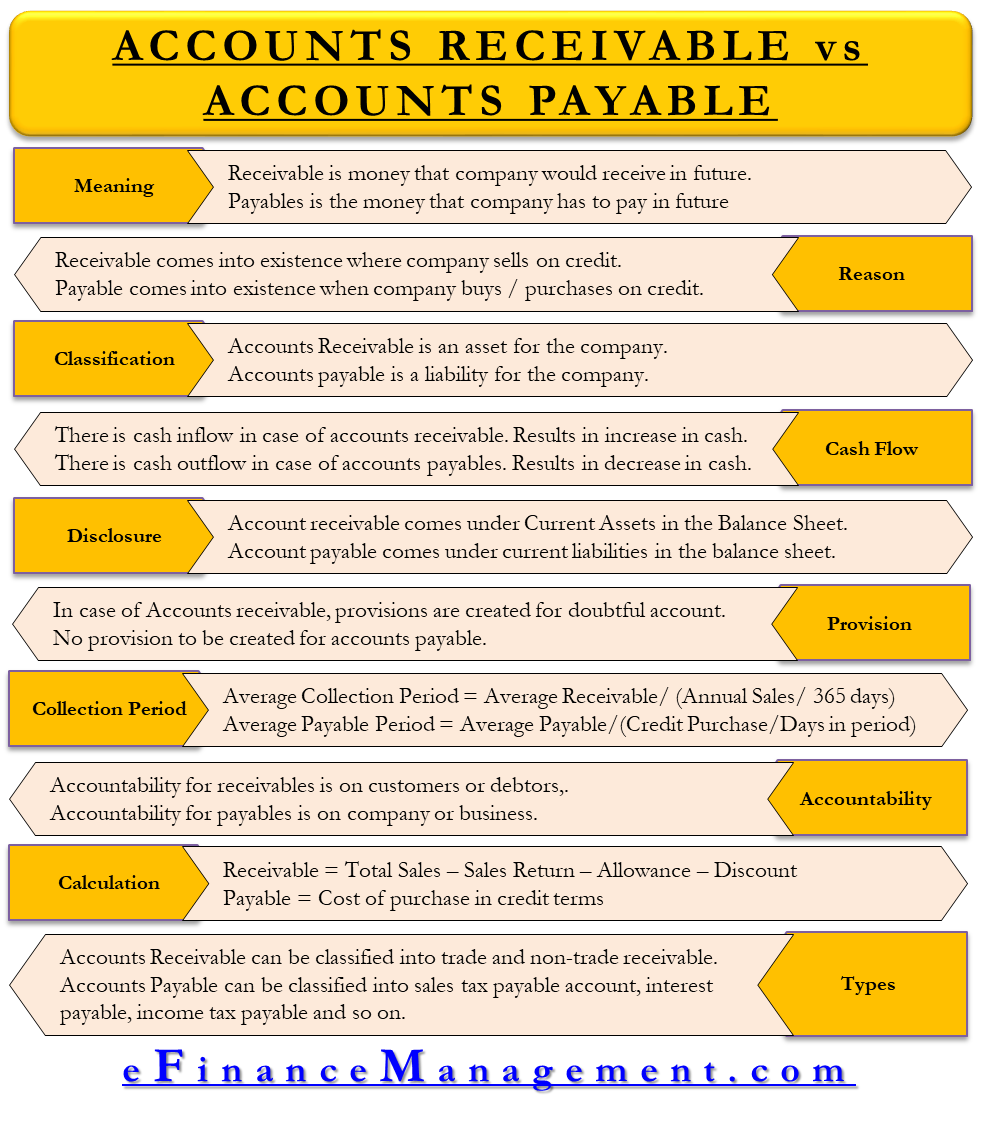

Difference Between Accounts Payable And Accounts Receivable Compare The Difference Between Similar Terms

Accounting for a Doubtful Debt.

. Explain how each case is treated and shown in accounting. Prepare one journal entry to summarize all accounts written off against the allowance for doubtful accounts in. In other words accounts payable is a current liability and accounts receivable is a current asset.

Q7-13 The accounting treatment of receivables factored with or without recourse depends on whether the sale criteria are met. Accounting questions and answers. Explain the LIFO retail inventory method.

The higher this ratio is the faster your customers are paying you. No special accounting treatment is required for the assignment of all accounts receivable as collateral for debt. Accounts receivable factored without recourse are accounted for as the sale of an asset.

Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. Errors on the companys books. 1 profit and 2 assets.

In addition note disclosure may be required. Explain the difference between making an allowance for bad debts and writing off a bad debt. Accounts payable AP and accounts receivable AR go hand in hand and are vital to cash flow management.

In this case the responsibility for collection of receivables rests solely with that company. 60000 2000 30. If a company has accounts receivable from ordinary customers and from related parties can they combine those receivables in their financial statements under US.

This means XYZ Inc. Manual Accounting is a system of accounting that uses physical registers and account books for keeping financial records. Q 7-13 Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse.

Explain how the accounts receivable and inventory should be valued on the financial statements. When the money owed by a party to another party called creditor then accounts payable is signed. Explain any possible differences between accounting for Question.

Some of the reasons for a difference between the balance on the bank statement and the balance on the books include. It is a short duration loan of a business for goods and services purchased on account. Students also viewed these Accounting questions Accounting for the transfer of receivables with recourse has been problematic.

When the money owed to a party by another party called debtor then accounts receivable is signed. The difference between accounts receivable and notes receivable is mainly decided based on the ability to receive interest and the availability of a legally binding document. Explain the difference between cash and accrual basis methods of accounting and how each method would produce different profit or loss for any given period.

The default risk of notes receivable is much less due to the legal status involved while the requirement to enter into a legal contract may often depend on the sum of credit given and the. Briefly explain the difference between the income statement approach and the balance sheet approach to estimating bad debts. Identify two advantages of dollar-value LIFO compared with unit LIFO.

The receivables used as collateral are simply described in a separate disclosure note. If a company has accounts receivable from ordinary customers and from related parties can they combine those receivables in their financial statements under US. Thirty is a really good accounts receivable turnover ratio.

Allowing the buyer to defer payment Briefly explain the difference between the from ACC 301 at Pace University. Bank service charges and check printing charges. The aim with accounts receivable and payable is for you to get paid as quickly as possible.

The two types of accounts are very similar in the way they are recorded but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. The difference between the book value and the fair value of proceeds received is recognized as a gain or a loss.

Has an accounts receivable turnover ratio of 30. For a doubtful debt create a reserve account also known as a contra account for accounts receivable that may eventually become bad debts estimate the amount of accounts receivable that may become bad debts in any given period and create a credit to enter the amount of your estimate in this reserve account which is known as. To calculate the accounts receivable turnover ratio we then divide net sales 60000 by average accounts receivable 2000.

The income statement approach estimates bad debt as a percentage of net credit sales. Explain any possible differences between accounting for an account receivable factored with recourse compared with one factored without recourse. The balance sheet approach estimates bad debt by estimating the net realizable value of accounts receivable.

If they are not met the factoring is accounted for as a loan. The key difference between accounts payable and accounts receivable is that accounts payable tracks money you owe and accounts receivable tracks money others owe you. Recording is possible through book of original entry.

Electronic charges and deposits that appear on the bank statement but are not yet recorded in the companys records. Is any special accounting treatment required for the assigning of accounts receivable in general as collateral for debt. If the business was to apply the correct measurement basis determine the effect on.

Computerized Accounting is an accounting system that uses an accounting software for recording financial transactions electronically.

Accounts Payable Vs Accounts Receivable Overview Of Differences

Should Accounts Receivable Be Considered An Asset Billtrust

Accounts Receivable Vs Accounts Payable All You Need To Know

0 Response to "Explain Any Possible Differences Between Accounting for an Account Receivable"

Post a Comment